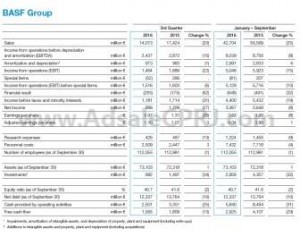

” BASF Net Sales in 2016 Q3 Dropped 20% to €14.0 Billion “

BASF Group‘s sales decreased by 20% in the third quarter of 2016 to €14.0 billion, mainly as a result of the divestiture of the gas trading and storage business as part of the asset swap with Gazprom at the end of September 2015.

Moreover, sales prices were reduced (-5%) by lower raw material prices. The volumes increase (+4%) was primarily supported by the Functional Materials & Solutions and Chemicals segments.

“Demand from the automotive and construction industries in particular remained robust worldwide. In Europe, we saw moderate growth across all sectors. The summer lull in July and August was less pronounced than in prior years. In Asia, the upward trend continued in the third quarter. Growth in China was slightly higher than we had expected at the beginning of the year. Demand in North America developed modestly; however, we experienced continued positive momentum in the automotive and construction industries. Economic development in South America remained weak and business confidence low. Volumes decreased, especially in Brazil, our largest market in the region,” said Dr. Hans-Ulrich Engel, Chief Financial Officer of BASF SE.

BASF’s expectations for the global economic environment in 2016 have only been adjusted in terms of the oil price (previous forecast in parentheses):

– Growth in gross domestic product: 2.3% (2.3%)

– Growth in industrial production: 2.0% (2.0%)

– Growth in chemical production: 3.4% (3.4%)

– Average euro/dollar exchange rate: $1.10 per euro ($1.10 per euro)

– Annualized average price of a barrel of oil: $45 ($40 per barrel)

The company also assumes that the logistic and supply bottlenecks resulting from the fire at the North Harbor in Ludwigshafen, Germany headquarters will negatively impact earnings for the business year, though they have not resulted in a change in the outlook for 2016.

Breaking down its performance by segment, sales in the Chemicals segment declined by 7% to €3.4 billion compared with the third quarter of 2015. This was due to lower prices on account of decreased raw material prices, especially in the Petrochemicals and Intermediates divisions. Volumes were raised overall, said BASF.

Sales amounted to €3.8 billion in the Performance Products segment, 3% below the previous third quarter’s level. Prices fell, owing primarily to the oil-price-related reduction in raw material costs, as well as ongoing pressure on prices in the hygiene business.

In the Functional Materials & Solutions segment, increased volumes led to sales growth of 3%, to €4.7 billion. Volumes especially rose in business with the automotive industry. Demand from the construction industry remained at an overall high level. Lower prices, negative currency effects and the divestiture of the global Polyolefin catalysts business slightly dampened sales, explained the company.

Sales in the Agricultural Solutions segment declined by 3% year-on-year to €1.0 billion because of lower volumes.

At €618 million, sales in the Oil & Gas segment were 83% lower than in the same quarter of the previous year, primarily as a result of the divestiture of the gas trading and storage business.

Source : China Plastic & Rubber Journal