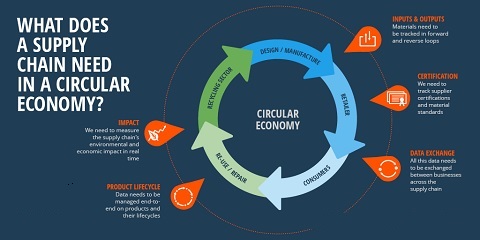

In the past decade, the world started to move away from the traditional linear economy of “take, make, dispose” mode of production to embrace the circular economy. The shift to a more circular economy, where the value of materials and resources is retained in the economy for as long as possible, and the generation of waste reduced, aiming to develop a low carbon, competitive and sustainable economy.

In the past decade, the world started to move away from the traditional linear economy of “take, make, dispose” mode of production to embrace the circular economy. The shift to a more circular economy, where the value of materials and resources is retained in the economy for as long as possible, and the generation of waste reduced, aiming to develop a low carbon, competitive and sustainable economy.

New record year for German and Italian machinery manufacturers

The year of 2017 is a rewarding one for both German and Italian plastics and rubber machinery manufacturers despite financial slowdown. VDMA Plastics and Rubber Machinery Association and AMAPLAST announced the encouraging performance of the industry during the year.

According to VDMA Plastics and Rubber Machinery Association, the German plastics and rubber machinery manufacturers rushed from one record to the next and increased their sales by another 5% in 2017.

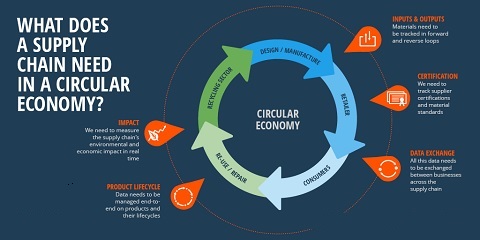

Top 10 German plastics and rubber machinery export destinations.

Since the economic crisis, which had also affected the plastics and rubber machinery manufacturers, this had been the eighth year of growth in a row. The current boom has been lasting unusually long.

The pole position of the most important German sales markets was again occupied by the US last year. The value of plastics and rubber machinery, which was delivered from Germany to the US, added up to €847 million.

The most important total market, however, is China. Besides exports of €717 million (+14.3% compared to 2016), about another half billion could be added, which were produced by the plastics and rubber machinery manufacturers in China mainly for the local market.

Due to the companies’ full order books, the VDMA Plastics and Rubber Machinery Association expects a growth of 3% in 2018.

On the other hand, AMAPLAST also announced its new all-time records for the sector with double digit increase over 2016 in all macroeconomic indicators.

AMAPLAST analyses show production sustained by excellent performance in exports, the destination for 70% of the Italian-made products in the sector, as well as by the domestic market. The expansion of the domestic market is also signaled by quite positive performance in imports.

Regarding macro-areas, the geography of exportation has witnessed overall growth in European destinations, mainly within the EU, where the top two export markets, Germany and France, have grown by more than 20% points since 2016.

However, the trend in sales to Asia has not been particularly brilliant due to a slowdown in exports to the Middle East (especially Saudi Arabia and Iran), and only modest growth (less than +5%) in sales to the Far East, where the two major markets have slipped: China (-2.5%) and India (-6%).

************************

Why Be a “Paid-Subscriber”?

Keeping an independent media in countries that impose limitations on self supporting media, will help to support the humankind’s freedom. If you believe it, please act to be a PRO-MEMBER by clicking “HERE“, or:

Please send your PR’s directly to my email address to be published in the world via ” http://pimi.ir ” my address is: aasaatnia@live.com