Increased in supply and demands encountered with lower trade volumes and continuation of market growth were the highlights of the Iranian polymer market at the 2nd week of July (almost the 3rd week of the Iranian month 04), because in total only less than 70% of supplies were purchased by traders.

Increased in supply and demands encountered with lower trade volumes and continuation of market growth were the highlights of the Iranian polymer market at the 2nd week of July (almost the 3rd week of the Iranian month 04), because in total only less than 70% of supplies were purchased by traders.

At the 2nd week of July a total number of 82 different grades were exposed at the IME hall and out of these 82 grades only 30 grades were sold in competitive markets and the others followed the base prices defined by the price committee. The competitive range were something between 1 – 13% because of more than 30.000 tons of demand was added to the normal demands in previous weeks.

The following charts show the relative supplies and demands.

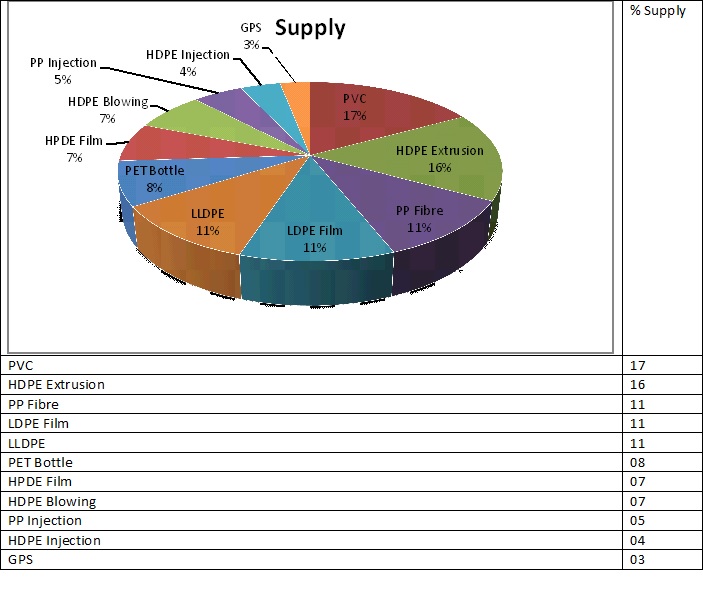

1- Supplies

The following table shows the percentage of supplies and its relative chart in the so called week:

The highest supply belonged to the HDPE material including extrusion, pipe and injection grades with a total increase of extra 7715 tons in supply. PVC stood at the next step by an increase of 2972 tons in supply and in comparison with the former week.

The highest decline in supply belonged to the LDPE film grade with a decrease of 2840 tons, also the fibre grade of PP experienced 2520 tons of less supply. Next, LLDPE with a decrease of 1311 tons was the 3rd material which faced with decline in supply.

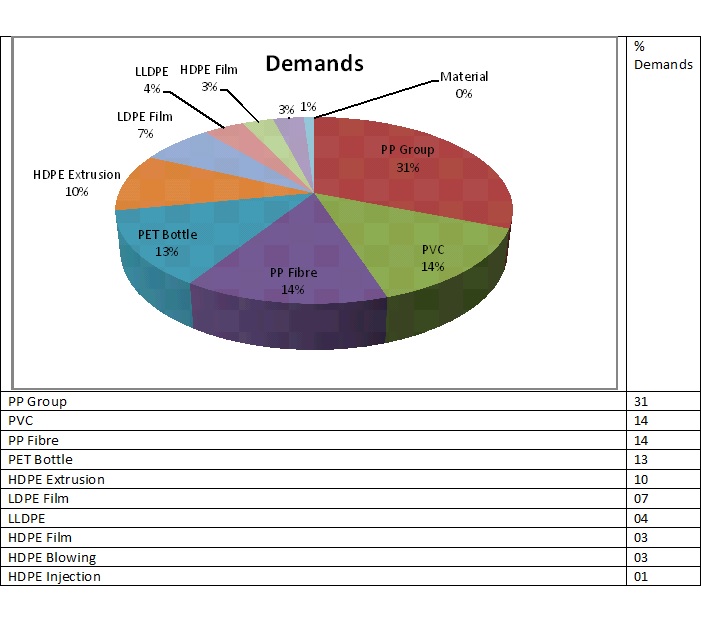

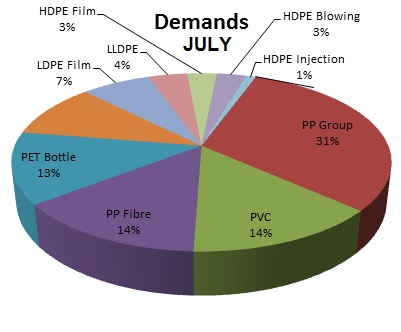

2- Demands

Demands for polymer at the 2nd week of July in comparison with its former week increased by 4522 tons, which is a considerable demand and increase in demand. Once again such increase in demand shows that long holidays, specially at the first quarter of the Iranian calendar year has a very negative impact on production and productivity. Considering demand increases at the first week of July which in total passed the level of 34000 tons for the first two weeks of July, sounds kind of improvement in deals and market. The following table shows the figures and the related chart: