Washington — The U.S. plastic bottle recycling rate held steady at 29% in 2018, and depending on who you listen to, that was either evidence of industry strength in a tough business or that bottle recycling was falling flat in its attempts to become more sustainable.

Two industry trade groups released the 2018 report on Dec. 18 and argued that while the rate and pounds collected were essentially unchanged, there were positive trends. They pointed to continued expansion of domestic U.S. bottle recycling and growing demand for recycled content plastic because of commitments from large consumer product companies.

“Plastics recycling is a vibrant, resilient industry that continues to remain strong in a challenging environment,” said Steve Alexander, president of the Association of Plastic Recyclers in Washington, one of the groups that put out the report.

“Despite the reduction in export markets, demand for quality recycled material remains robust, and many recyclers are investing in updating and expanding our domestic infrastructure to meet that demand,” he said.

But the environmental perspective was different, with stagnant or falling recycling rates meaning that the industry is not making measurable progress.

The head of the Container Recycling Institute said increasing use of plastics in bottles and falling recycling rates in recent years mean that the U.S. is increasing the amount of plastic bottle waste it sends to landfills and incinerators.

Culver City, Calif.-based CRI estimated that the U.S. trashed about 7.2 billion pounds of plastic bottles in 2018, compared with 5.5 billion pounds landfilled or incinerated in 2000.

“As a result of the increased production levels and the declining recycling rates, we are throwing away more and more plastic bottles each year,” said CRI President Susan Collins. “Compared to the year 2000, we’re creating 30 percent more plastic bottle waste.”

The report, from APR and the American Chemistry Council, said that the overall plastic bottle recycling rate fell to 28.9% in 2018, down slightly from 29.3% in 2017.

For PET bottles, which account for about 63 percent of all plastic bottle recycling, the rate was also 28.9% in 2018, down from 29.2%.

For high density polyethylene, which accounts for 35% of plastic bottle recycling, the rate in 2018 was 30.4%, down from 31.1% in 2017.

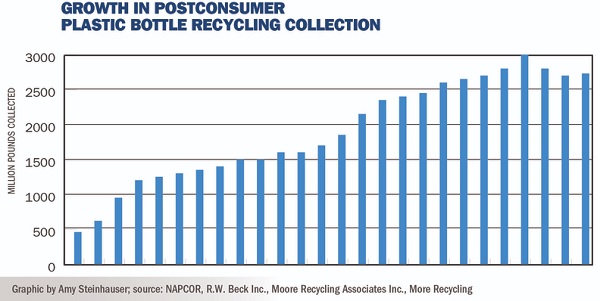

In the United States, 2.85 billion pounds of plastic bottles were collected for recycling in 2018, up from 2.8 billion pounds the year before. Collection of PET was up about 90 million pounds while HDPE dropped 40 million pounds.

The report said the U.S. continues to recycle more bottle waste domestically and export less, a long-term trend it said was pushed along by China’s National Sword restrictions on imported plastic waste.

In 2018, about 9.9% of bottles were exported, down from more than 40% a decade ago and 20 percent in 2016.

Overall, the report said it was a tough environment for bottle recycling, with the industry not keeping pace with growth of plastic bottle packaging on store shelves and being hurt by low prices of virgin plastic.

“The post-consumer plastic bottle recycling industry experienced a third difficult year in 2018 with less growth in pounds collected than in pounds of bottles on store shelves,” the report said.

As well, it said low prices for virgin materials made for a tougher economic situation for plastic recycling companies: “As a general matter, the cost of petroleum and petrochemicals favored the economic competitiveness of virgin plastics compared to post-consumer plastic.”