The Middle East Moves UP in Downstream Industries: According to a report published by CPRJ International the growth of downstream industries of the petrochemical industries is on the way and there are more hopes for moving up of Iran. Part of the report says:

The vast amount of petroleum resources, the Middle East has a strong backbone for developing the plastics industry, but its growth is hindered by political instability in the region. The Gulf Cooperation Council (GCC) is a relatively stabilized region, which is setting its sight on promoting its plastics processing industry. Outside of GCC, Iran is about to become the industry’s favorite now that the sanction was lifted.

Saudi Arabia and UAE leads the way

Compared with other parts of the Middle East, the GCC region has not been as severely affected by the Syrian crisis, whilst free trade and investment incentives have seen infrastructure increasingly grow and a growing services sector contribute more to the economy, counteracting the impact of low oil prices.

GCC is a regional intergovernmental political and economic union consisting of all Arab states of the Persian Gulf, except for Iraq. Its member states are Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates (UAE).

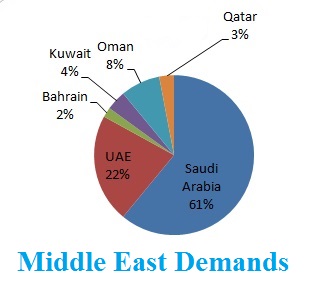

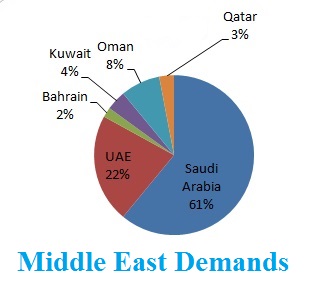

Saudi Arabia and the UAE account for 83% of the plastics processed in the region with a high demand for commodity polymers whilst engineering polymers demand remains very low at less than 1% of total polymer demand in the region, according to Applied Market Information (AMI).

Even the smaller countries of Bahrain, Kuwait, Oman and Qatar exhibit growth and potential. In particular, the 2022 World Cup in Qatar has created major construction projects benefitting the plastics industry.

Combined with the World Expo in Dubai 2020 and on-going residential construction across the region it is easy to see why the plastics processing industry in the GCC is expected to be stronger than the rest of the Middle East, with growth forecast at a little over 3% and total polymer demand expected to be just under 5 million tons by the end of 2016, said AMI.

Further evidence for this stable market is the rising incomes and reduced unemployment that will continue to drive demand for a large amount of consumer and household goods and appliances.

According to AMI’s report, the region is now moving onto the next stage of its development program, with a special focus on downstream industries and plastics conversion. Leading the way are Saudi Arabia and the UAE which have introduced a series of initiatives to boost growth of small and medium-sized industries (SMEs) for plastics processing.

Documenting the development of plastics processing in the region, AMI has recently released the latest version of its database of Plastic Processors in the GCC, which include over 470 production sites across the region. There have been 114 sites added since the previous edition with a number of existing sites also expanding to cover new processes, according to AMI’s database.

Based on the following chart, and in the same regard, the German machine manufacturers are trying to keep their highest shares at this great market.

Please read more at the : SOURCE