Two-Months Report on Polymer Demand and Supply in Iran

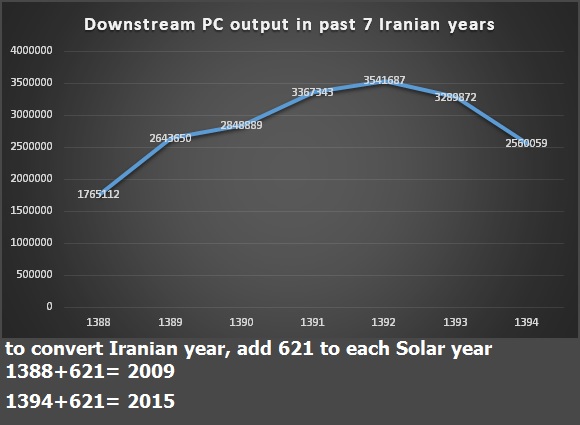

In the first two months of the current Iranian fiscal year (starting March 21), polymer supply in the country stood at 511,390 tons, showing a decline by 72,176 tons from the same period of the previous year (583,566 tons) as shown in Fig 01.

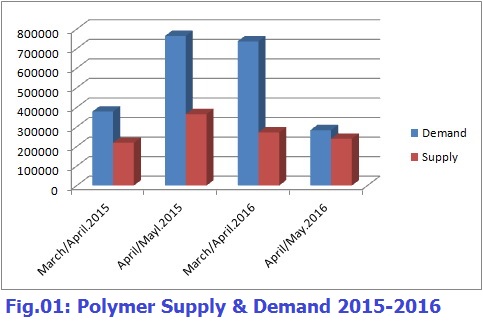

In the first month, the supply was 53,000 tons more than that of the same month last year, but things altered the following month, which saw a decline by 34 percent (Fig 02)

Supply reduction in the first month of the Iranian new year (March 21st– April 30th) is reasonable due to long holidays, however an increase in the following month is always expectable as happened last year. This year’s considerable supply reduction was not good news from the consumers’ viewpoint which paid more for increased prices of materials. One reason for the decline could be the overpowering of the foreign market vis a vis the local, not a good situation for the local market.

On the other hand, while the overall demand had stood at 1.143 thousand tons last year during the said two-month period, it declined by 10 percent to reach 1.02 in the current year.

A reason for this situation could be the growing prices of polymers in the Asian and the global markets.

Yet here also, in the first month of this year, demand grew by 129 percent compared to the same month last year.

However, a great part of the demand was fake, especially for the textile industry PolyPropylene as well as PVC products, especially in the first week of the month. The fake demands were absent last year. Tax relief rules which are imposed during current year have had an important role in more reliable demand registrations.

Demand grew uniquely small in the second month, downgrading from 737 thousand tons last year same month to 283 thousand in the present, a decline by 260 percent.

It is noteworthy that during the same period, prices globally were on the decline.

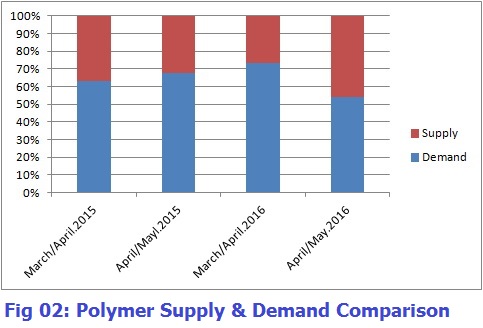

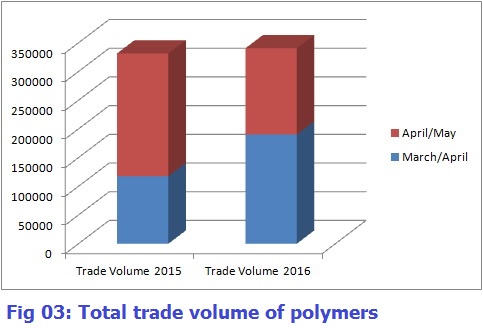

The total trade volume in the said two-month period in the country stood at 340,563 tons, growing by 9 percent since a year earlier (Fig 03).

One special consideration here is the large volume of polymer smuggled to neighboring countries such as Afghanistan, Pakistan, and Iraq.

Trade in the first month grew by 60 percent_ from 117,000 to 190,000 tons_ compared to the same month last year, but showed a decline of 30 percent in the second month compared to the second month of the previous year, that is, from 213 thousand tons to 150 thousand.

Declining global prices, unsteady oil prices which discourage activists, petrochemical companies’ blockade of the activity of tax-exempt codes, the domestic market’s low intake, severe decline in the supply of many attractive grades, weak complementary industry exports, and a lowering smuggled volume could all have counted for the decline.

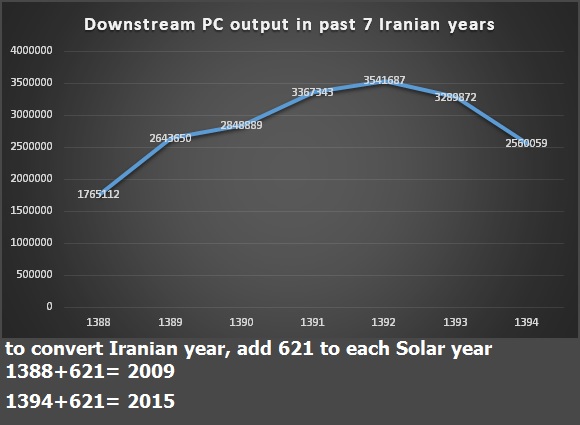

The following chart shows the output of the Iranian PC compleces’ out put between 2009-2015.