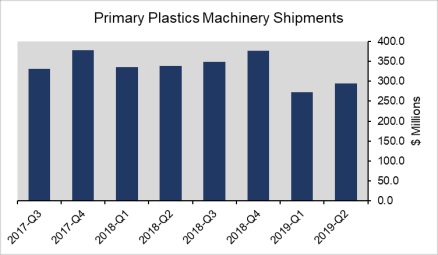

WASHINGTON, DC—August 16, 2019—The shipments value of primary plastics machinery (injection molding and extrusion) shipments in North America increased in the second quarter according to the statistics compiled and reported by the Plastics Industry Association’s (PLASTICS) Committee on Equipment Statistics (CES).

Following a 27.6% decrease in the first quarter, plastics machinery shipments increased 8.2% in the second quarter. However, shipments remained sluggish from the second quarter of the previous year—12.7% lower.

The preliminary estimate of shipment value from reporting companies totaled $295.3 million. Injection molding shipments rose 7.4% and single- and twin-extrusion equipment shipments increased 13.6% and 13.9%, respectively. While the value of shipments for single-screw extruders and injection molding equipment increased 4.3% and 7.4%, respectively, for a year ago, twin-screw extruders were 29.5% lower.

“The second quarter numbers are encouraging, but machinery shipments remain comparatively lower than the previous quarters. What’s happening is not surprising judging from the macroeconomic environment. Real business investment spending in the second quarter fell 5.5%. In particular, the investment spending in industrial equipment flattened in the second quarter,” according to Perc Pineda, PhD, chief economist of PLASTICS.

The CES also conducts a quarterly survey of plastics machinery suppliers that asks about present market conditions and expectations for the future. In the coming quarter, 56% of respondents expect conditions to either improve or hold steady—lower than the 70% that felt similarly in the previous quarter. As for the next 12 months, 53% expect market conditions to be steady-to-better, down from 60% in the previous quarter’s survey.

On the international trade front, plastics machinery exports in the second quarter totaled $378.8 million—a 4.3% increase from the previous quarter. Mexico, Canada and Germany remained the largest U.S. export markets. More than half (53%) of U.S. plastics machinery was exported to these three countries. While exports to China increased 11.4% in the second quarter, it was 37% lower than during the same period the previous year. “In the short-term there are two outstanding issues that need to be resolved. Mexico has ratified the U.S.-Mexico-Canada Agreement (USMCA), but the U.S. and Canada have yet to sign off on this critical North American trade pact. Both countries must ratify the USMCA. Unless that is resolved, the uncertainty from the ongoing U.S.-China trade dispute will continue to run high and will negatively impact not only the plastics industry but the global economy,” Pineda added.

###

About PLASTICS Committee on Equipment Statistics (CES)

The PLASTICS Committee on Equipment Statistics (CES) collects monthly data from manufacturers of plastic injection molding, extrusion, blow molding, hot runners and auxiliary equipment. A confidential, third-party fiduciary, Vault Consulting, LLC, compiles the monthly data and analyzes individual company data for consistency and accuracy. Once this crucial process is completed, Vault aggregates and disseminates reports to participating companies.

About Plastics Industry Association

The Plastics Industry Association (PLASTICS), formerly SPI, is the only organization that supports the entire plastics supply chain, representing nearly one million workers in the $432 billion U.S. industry. Since 1937, PLASTICS has been working to make its members and the industry more globally competitive while advancing recycling and sustainability. To learn more about PLASTICS’ education initiatives, industry-leading insights and events, networking opportunities and policy advocacy, and North America’s largest plastics trade show, NPE.