Last week due to the end of Ramadan and a week with two consecutive holidays on the occasion of “Eid-al-Fatir” which practically resulted in a one full vacation of many private companies, for the first time at this Iranian year of 1396 (March 21st 2017- March 20th 2018) the volume of supplied (offered) polymers by petrochemicals faced with such a limit of decline. At this year and at each week the amount of supply volumes have always been more than 70.000 tons.

Last week due to the end of Ramadan and a week with two consecutive holidays on the occasion of “Eid-al-Fatir” which practically resulted in a one full vacation of many private companies, for the first time at this Iranian year of 1396 (March 21st 2017- March 20th 2018) the volume of supplied (offered) polymers by petrochemicals faced with such a limit of decline. At this year and at each week the amount of supply volumes have always been more than 70.000 tons.

According to the news released by stock exchange experts, at the first week of Tir Maah (the 4th Iranian calendar month= June 22-29th) the IME hall experienced the lowest trade volumes due to religious holidays. Though at the previous week the volume of offers were about 61.000 tons.

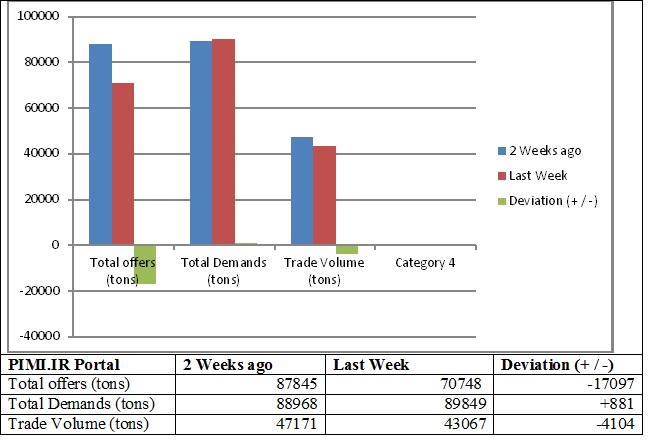

During the last week the total volume of deals faced with more than 8000 tons, were the IME hall experienced more than 17.000 tons of demands and near 10.000 tons decline in supplies (note to table 1 below). This shows a total of more than 26.000 tons of decrease in polymer supplies.

Table 1: Comparison Charts for weeks: June 18th – 25th (2 weeks ago) and June 25th – July 2nd 2017 (last week)

| Comparison table for polymer markets in Iran between two above weeks | |||

| PIMI.IR Portal | 2 Weeks ago | Last Week | Deviation (+ / -) |

| Total offers (tons) | 70748 | 60939 | -9809 |

| Total Demands (tons) | 89849 | 72629 | -17220 |

| Trade Volume (tons) | 43067 | 34971 | -8096 |

US$ for calculation of the base price for deals at IME: For 2 weeks ago, 1US$= 37.450 Rials and for Last week the committee decided to keep all prices constant for the 3rd month of the Iranian Calendar and the two first weeks of next month. The price of 1US$ at the free market was 37.650 Rilas.

Notice: The US$ price and base price definitions were neglected for the first week of the 4th months of Iranian Calendar (June 22nd-July 22nd)

The highest decrease in supplies belongs to blowing grades of HDPE with 3000 tons of less polymer offers. Also film grade of LDPE has experienced a decrease of about 2502 tons, where the LLDPE showed 2057 tons of decreasing in offers. At the same time the injection grade of HDPE faced with 1230 tons in supply.

However, the injection grade of PP with 272 tons increase showed an increase in supply of this polymer. As far as demands are concerned, the highest demand belonged to the grade ZR230C of PP which recorded more than 13.000 tons and so found a very competitive price in the polymer markets. Table 2 shows the comprehensive situation of polymer deals during the last low volume polymer market in Iran.

Table 2: Materials Statistics Between June 18th-25th (2 weeks ago) and June 25th -July 2nd 2017 (last week)

| Grade | Offers

(Two week ago-tons) |

Average

Base Price (Last Week) |

Highest

Sold Price (Rials) |

Offers

(Last Week) (tons) |

Demands

(Last Week-tons) |

Trade

Volume (Tons) |

Offers

Deviations Volumes +/- |

|

| ABS | ||||||||

| Natural-50 | 70 | 67845 | 75600 | 190 | 70 | +20 | ||

| Natural-75 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| HDPE | ||||||||

| Blowing | 6832 | 36238 | 37359 | 2832 | 772 | 772 | -3000 | |

| Extrusion | 7312 | 40518 | 41204 | 6812 | 6384 | 5340 | -500 | |

| Injection | 2625 | 36452 | 36452 | 1395 | 154 | 132 | -1230 | |

| Film | 4550 | 38253 | 38.353 | 4704 | 1280 | 1126 | +154 | |

| Rotational | 433 | 38092 | 38957 | 0 | 0 | 0 | 0 | |

| LDPE | ||||||||

| Film | 10008 | 41016 | 45118 | 7506 | 5572 | 3286 | -2520 | |

| Injection | 41724 | 45869 | 110 | 550 | 110 | ?? | ||

| LLDPE | ||||||||

| Film | 8283 | 38022 | 39325 | 6226 | 4224 | 3962 | -2507 | |

| PC | ||||||||

| PET | ||||||||

| Bottle | 4840 | 33644 | 38219 | 5038 | 10549 | 5038 | +198 | |

| PP | ||||||||

| Injection | 2367 | 42704 | 46974 | 2639 | 24167 | 2061 | +272 | |

| Fibre | 8763 | 37679 | 39019 | 8017 | 11294 | 7973 | -746 | |

| Film | 528 | 38032 | 41836 | 0 | 0 | 0 | 0 | |

| PS | ||||||||

| EPS | 250 | 48655 | 52890 | 0 | 0 | 0 | 0 | |

| GPS | 2050 | 46657 | 46657 | 2250 | 1120 | 680 | +200 | |

| HI-Impact | 600 | 49618 | 49618 | 600 | 0 | 0 | 0 | |

| PVC | ||||||||

| Susp’n | 9102 | 31318 | 34449 | 8194 | 5326 | 3504 | -908 | |

| Emol’n | 308 | 33823 | 40587 | 308 | 1694 | 308 | 0 | |

| SBR | ||||||||

| Dark | 590 | 45547 | 45547 | 210 | 105 | 105 | -380 | |

| Bright | 1020 | 49086 | 49086 | 720 | 62 | 62 | -500 | |